Online Trading

Whether you are a demanding trader who requires the performance and flexibility of a professional trading environment, or an investor who needs access on the go, we have got the right platform for you. CQG and TT. The tradeoff is between mobility and cross-device functionality on one side and professional-level trading power on the other. But you don’t need to choose. You can have both.

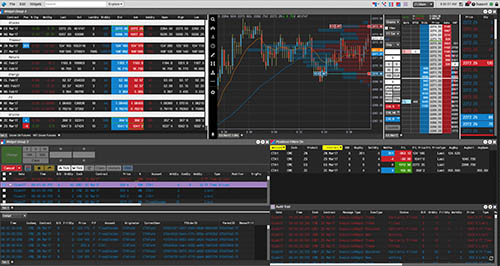

CQG offers powerful trading tools and technical analysis features to trade and monitor the markets. It combines analytics, charts, and multiple trade execution interfaces in one comprehensive solution for professional traders. Take advantage of our high-speed network of distributed exchange gateways and partnerships with over one hundred FCM environments and use this powerful application to view market activity, place and manage orders, and perform sophisticated technical analysis. Worldwide market coverage is available for over seventy-five futures, options, fixed income, Forex, equities, and news sources. Electronic trading connectivity is available to more than forty global exchanges.

TT gives you the trading tools that you expect in an easy-to-access platform. View real-time and historical market data and trade with the click of your mouse or automate your trading strategy and deploy your Algo to servers throughout our global network of co-located data centres for superior execution. TT provides you with various front-end applications for trading and managing risk. The Trade application on the TT platform provides you with the trading tools for viewing market data, submitting and managing orders, creating and trading synthetic spread instruments, viewing historical trade data using charts and analytics, and more.

Direct Market Access (DMA) – Electronic trading facilities that give investors the functionality of trading directly into an Exchange. The benefits of DMA include lower transaction costs, personal order management and live market data. Our DMA platforms include both the CQG and TT software suites.

From the one trading platform gain access to the Australian, Asian, European and US markets with highly competitive latency times and sophisticated charting and analysis.

Some traders do not have the time to trade online themselves. For those that are time poor we take the time to manage your orders for you. Our dealing desk has experienced advisers on all time-zones, from the Australasian, to European and the US sessions.

Trade the ASX/S&P SPI 200, Hang Seng, Nikkei 225, FTSE 100, DAX, Currency Futures, e-mini S&P 500 and mini Dow to name a few.

In accordance with the Corporations Act 2001 (Cth) and RG 212, JB Markets holds client money in a wash-through segregated client trust account in accordance with Australian Client Money Laws and Regulations.

We are not a market maker and only act as agent for investors who need access to domestic and international markets and as such, we do not take the other side of your trade and are not your counterparty. The exchange acts as counterparty through Novation. Therefore we do not need to Hedge any positions.

Client money sits in Australia in the allocated wash-through or client segregated trust account, it does not leave the country (Australia) or is withdrawn and invested elsewhere. Any money sitting in the wash-through account is protected by Client Money Laws and Regulations in Australia. JB Markets is governed and regulated by the Australian Securities and Investments Commission.